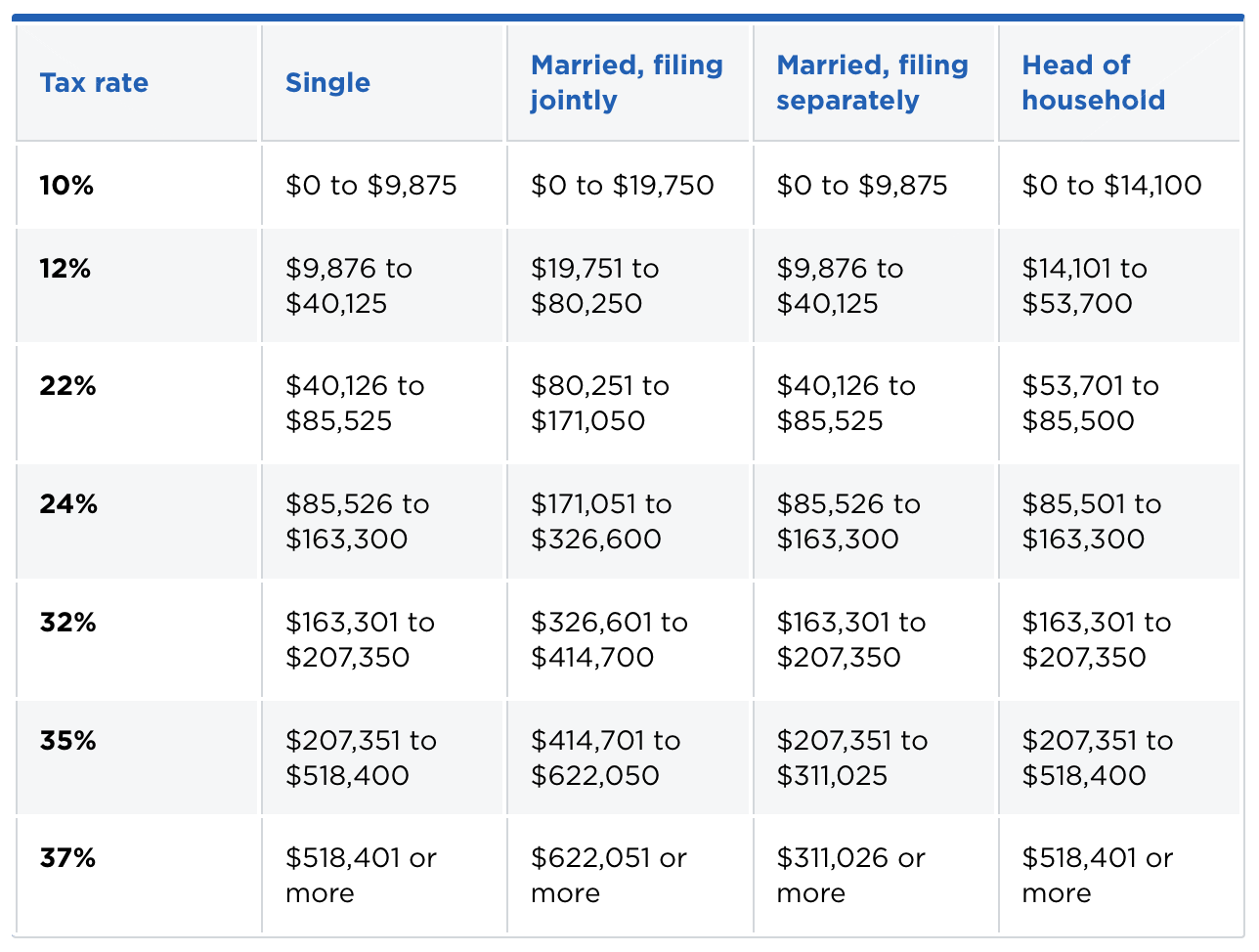

Tax Credits 2025 Maryland Income Limits. 50% of federal eitc 1; For calendar year 2025, the maximum pension exclusion is $39,500.

Income tax to be withheld from wages by employers during year 2025: To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and.

Maryland Withholding Tax Facts 2025 Joete Madelin, For calendar year 2025, federick and anne arundel counties tax rates were adjusted by adding new local tax brackets based on filing statuses and taxable income.

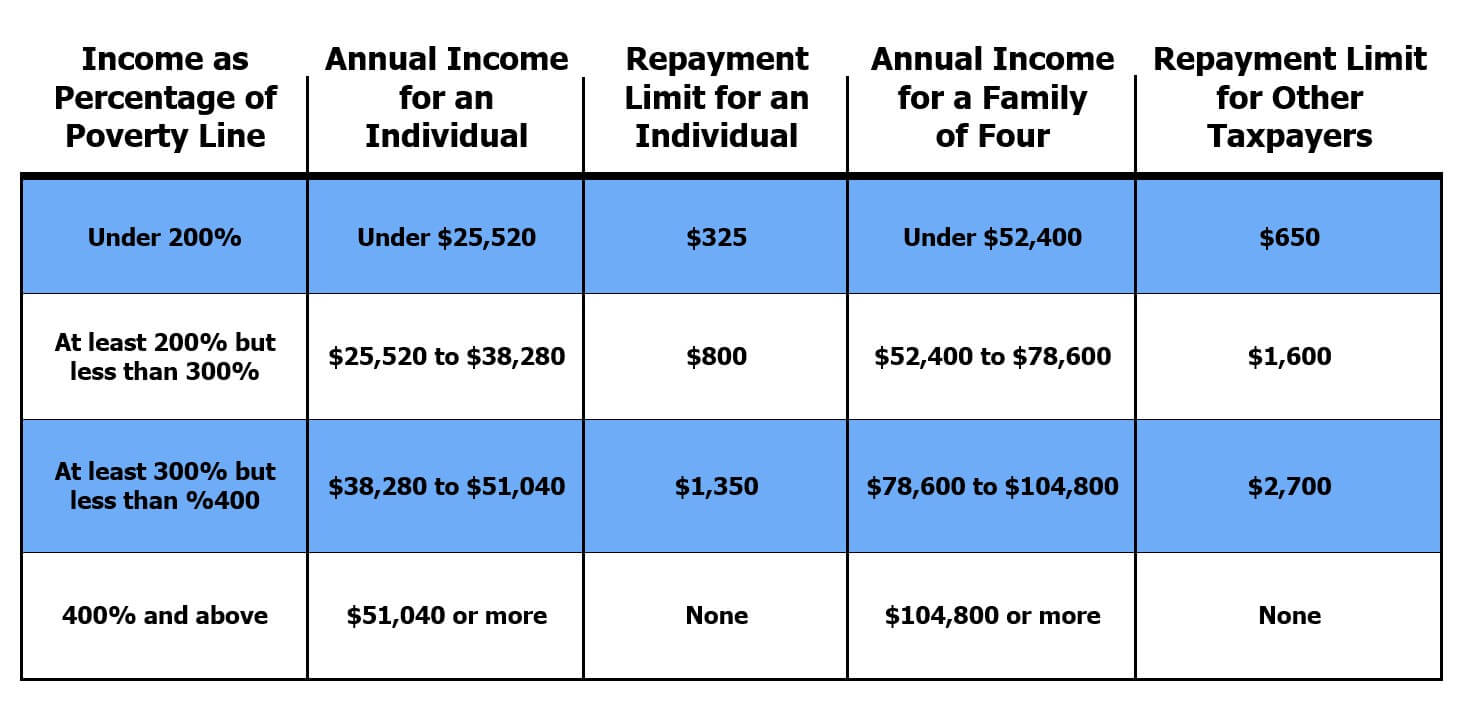

2025 Healthcare Limits Alix Lucine, For calendar year 2025, federick and anne arundel counties tax rates were adjusted by adding new local tax brackets based on filing statuses and taxable income.

Child Tax Credit 2025 Limits Erika Jacinta, Income tax to be withheld from wages by employers during year 2025:

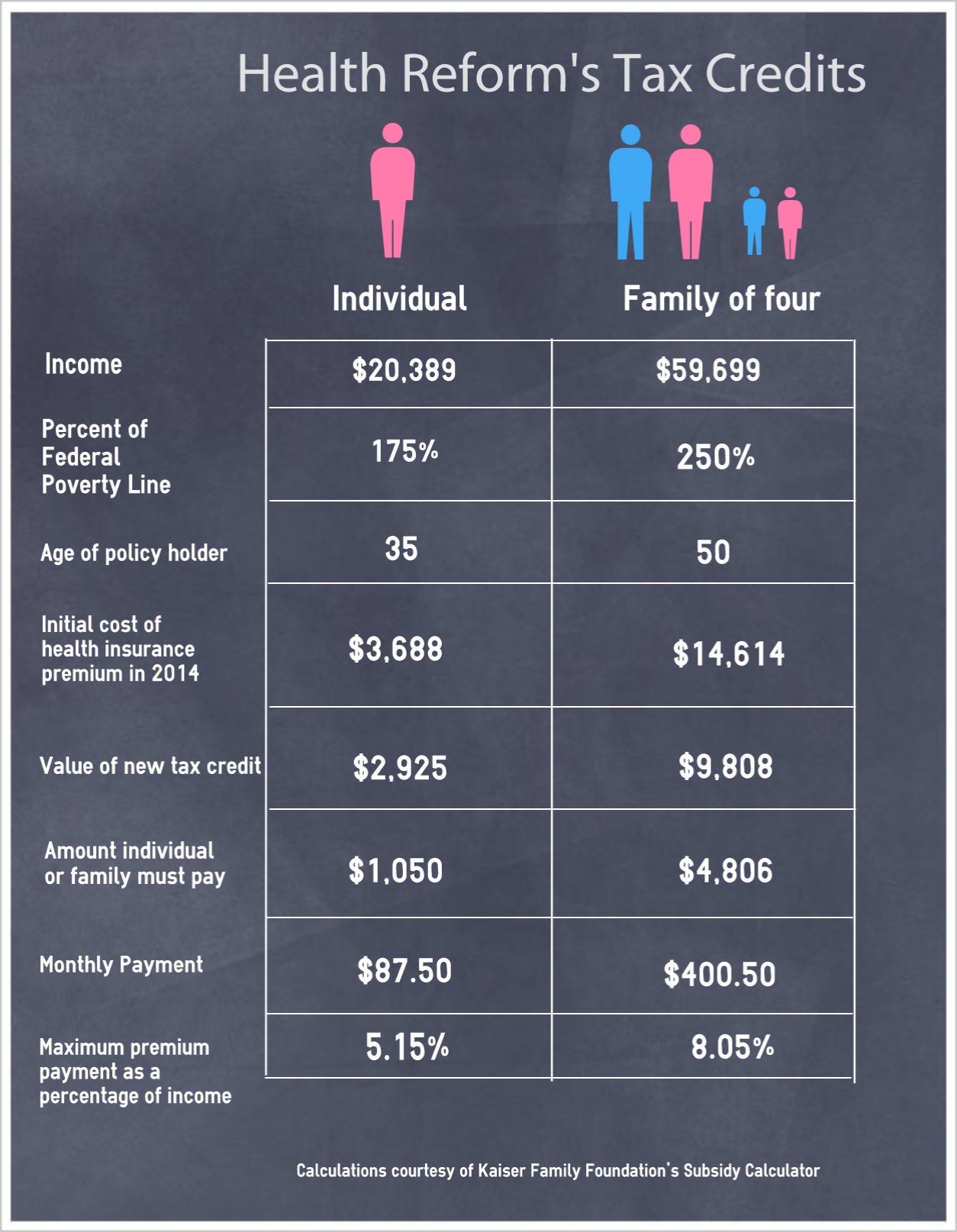

Earned Tax Credit for 2025. StepbyStep Guide YouTube, See more details on subsidies under the aca.

Maryland Tax Tables 2025 Tax Rates and Thresholds in Maryland, This subtraction applies only if:

Maryland State Tax Forms 2025 Heddi Kristal, Most people shopping for health insurance on the affordable care act marketplace are eligible for a tax credit that reduces how much they pay in premiums.;