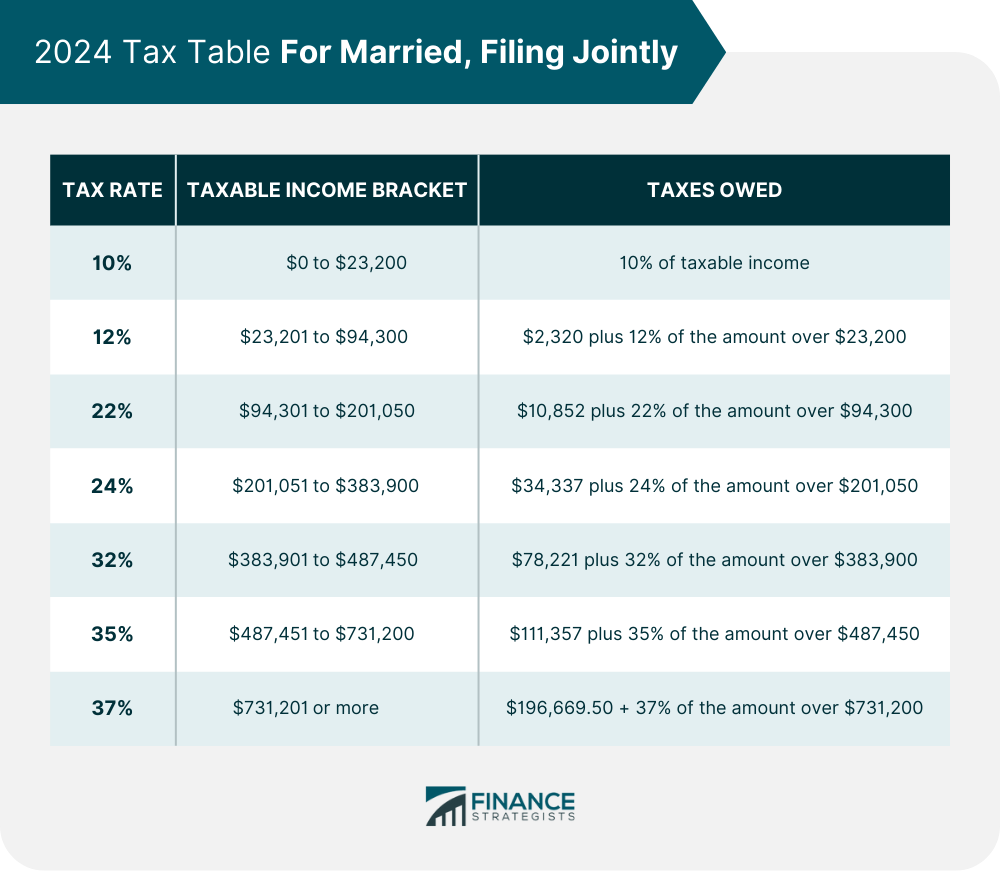

Tax Brackets 2025 Filing Jointly Or. 10% — single income of $11,600 or less and married couples filing. 10 percent, 12 percent, 22 percent, 24 percent, 32.

See current federal tax brackets and rates based on your income and filing status. Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much.

2025 Tax Brackets Married Filing Jointly Lexis Opaline, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax.

2025 Tax Brackets Announced What’s Different?, Tax brackets differ based on the filer's status:

2025 Tax Brackets Married Filing Jointly With Dependents Darda Elspeth, Incomes over $609,350 ($731,200 for married couples.

2025 Tax Brackets Single Filing Jointly Aurel Crissie, See current federal tax brackets and rates based on your income and filing status.

Tax Brackets 2025 Married Filing Jointly Cordi Paulita, Find the current tax rates for other filing statuses.

Tax Bracket 2025 Married Filing Jointly With Spouse Debera Kevina, For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025.

2025 Tax Brackets Irs Married Filing Jointly Nanon Ralina, Learn how marginal tax rates work, see tables for all filing statuses, and understand changes.

Irs 2025 Tax Brackets Married Jointly Dulcia Marissa, 37% for incomes over $609,350 ($731,200 for married couples filing jointly)

Tax Brackets Definition, Types, How They Work, 2025 Rates, For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, Generally, as your income increases, you’ll.